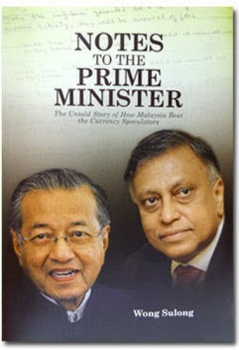

NOTES to the Prime Minister details Tan Sri Nor Mohamed Yakcop’s communications or advice to Prime Minister Tun Dr Mahathir Mohamad in connection with the outbreak of the Asian Financial Crisis in July 1997 to August 1998 when Malaysia introduced unorthodox capital controls to save the real economy from speculators and the IMF, that was clearly either ill informed or had an evil design to radically transform the ownership structure of the assets of the fundamentally strong real economy of Malaysia.

One comes out of the reading that it was Nor Mohamed’s brilliant analysis of the crisis that led him to persuade the Prime Minister to impose capital controls. Many have argued that the capital controls came a bit too late because most of the funds had left the economy, when capital controls were finally introduced on September 1, 2011. However, the Prime Minister according to the notes released in this edited book had taken into consideration all aspects of the situation and acted responsibly to save the real economy, jobs and businesses which otherwise may have been transferred via distress sales to the foreigners.

This is contrary to the view expressed in top tier academic journals that capital controls were introduced to save the Prime Minister’s cronies. A suspect method was used by the authors of these academic articles to identify cronies and the data manufactured was subjected to vigorous scientific testing to produce a largely erroneous conclusion. This clearly shows that science can be used to distort reality. It is timely that the release of this book puts an end to the “crony hypothesis of capital controls” that has been in vogue for some time.

I would not hesitate to recommend this book for a graduate course in International Finance as it gives a detailed account of hedging and forward trading strategies and the workings of the international financial markets on a day to day basis as the crisis unravels. The notes are the writings of an expert in the field of international finance with a detailed knowledge of forward markets and instruments used for speculation in both domestic and international financial markets that are interlinked. The students will find this book of immense value because it brings to life theory in a Malaysian setting.

I would not hesitate to recommend this book for a graduate course in International Finance as it gives a detailed account of hedging and forward trading strategies and the workings of the international financial markets on a day to day basis as the crisis unravels. The notes are the writings of an expert in the field of international finance with a detailed knowledge of forward markets and instruments used for speculation in both domestic and international financial markets that are interlinked. The students will find this book of immense value because it brings to life theory in a Malaysian setting.

Nor Mohamed correctly takes issue with the fact that Malaysia’s reserves during the crisis were deposited in foreign banks like Citibank in Europe and the US rather than in the domestic banks located in the Labuan Offshore Financial Centre. This is definitely reminiscent of the colonial era.

However, what is more damaging from a financial point of view is that Bank Negara deposits the money in foreign banks at a low interest rate and when Malayan banking needs foreign reserves it needs to borrow from a bank in Europe at inflated interest rates. What Nor Mohamed rightly questions is why could not these funds be deposited offshore in a Malaysian bank in Labuan and used at convenience to ward off currency speculators.

During the Asian Financial Crisis, the IMF and its supporters in Malaysia were pushing for high interest rates, Nor Mohamed correctly argued against the proposal to increase interest rates. His argument is that interest rates should be increased during a boom and not a recession.

The counter argument was that increasing interest rates would attract short term funds and this will help to strengthen the ringgit which was then in a free fall. However, increasing interest rates will cause the stock market to crash as margin financing may become too costly and as a result speculators and hedge funds will move their money out of Malaysia and cause the ringgit to depreciate further.

Nor Mohamed also pointed out at the time of the crisis that high interest rates will result in corporations not being able to service their loans and as a result the non-performing loans (NPLs) of banks will increase.

Nor Mohamed also makes the correct point that the fundamentals of the Malaysian economy were strong at the outbreak of the Asian Financial Crisis in 1997 and continued to be strong throughout the crisis. The free fall of the ringgit was then the work of currency speculators driven by animal spirits or what Nor Mohamed prefers to refer to as “greed and fear”.

The fact the real economy was strong was supported by the fact that exports were strong and FDI was still pouring in. Job losses were at a minimum. The Japanese had also taken the view that the real economy was fundamentally strong and had volunteered to set up the Asian Monetary Fund (AMF) to provide funds to kill the speculators at their own game. However, the Americans and the IMF objected to the setting up of the AMF.

As pointed out by (Jagdish) Bhagwati of Columbia University, the US Treasury-Wall Street complex together with the IMF were bent on creating havoc by driving the ringgit to a free fall by suggesting that the Malaysian economy was riddled with corruption and cronyism and over-investment in rent generating heavy capital investment projects.

Even Nobel Laureate, A.K. Sen speaking in Singapore at the time of the crisis was confident of recovery because he pointed out that the real economy was fundamentally strong.

The much discredited IMF had to eat its own words when years after the crisis it had to admit with much humility that “capital controls are necessary in some situations”.

Nor Mohamed’s notes are also more than sufficient to answer the question: “Can Asians think?”  The notes clearly show that not only can Asians think but they can think creatively and are brave enough to think “against the stream”, which is laudable.

The notes clearly show that not only can Asians think but they can think creatively and are brave enough to think “against the stream”, which is laudable.

The notes clearly show that not only can Asians think but they can think creatively and are brave enough to think “against the stream”, which is laudable.

The notes clearly show that not only can Asians think but they can think creatively and are brave enough to think “against the stream”, which is laudable.

This book confirms that it was a harrowing time for both Mahathir and Nor Mohamed but they managed to catch the bull by its horns and steer the economy back into a path of sustainable high economic growth. This is the best book on the Malaysian economy that I have read for some time.

*G. Sivalingam is Visiting Senior Research Fellow, Institute of Southeast Asian Studies in Singapore. Notes to the Prime Minister: The Untold Story of How Malaysia Beat the Currency Speculators by Wong Sulong is published by MPH Publishing, Kuala Lumpur (Price: RM69).

No comments:

Post a Comment